Title : Candlestick Chart Patterns Meaning

Link : Candlestick Chart Patterns Meaning

Candlestick Chart Patterns Meaning

This content is blocked. The next candle opens higher but reverses and declines the candle then closes below the center of the first candle.

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Candlestick Chart

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Candlestick Chart

Candlestick patterns are one of the predictive techniques used by traders all over the world.

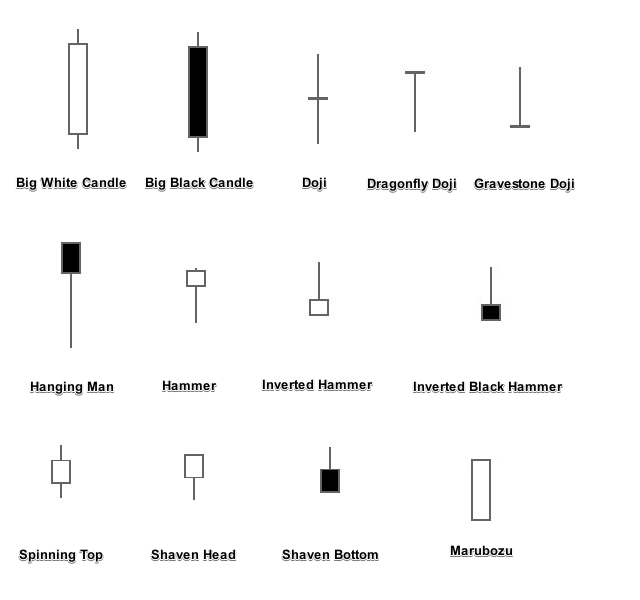

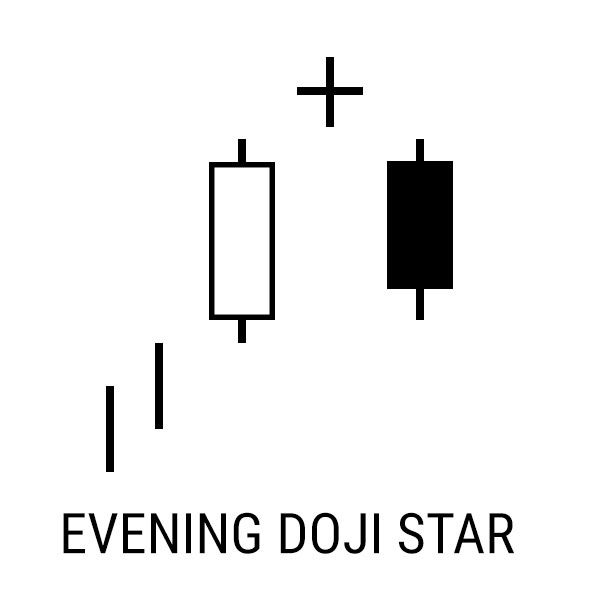

Candlestick chart patterns meaning. The candlestick charts are used in stock markets and forex markets among others. Traditionally the star will have no overlap with the longer bodies as the market gaps both on open and close. Candlestick Patterns Every trader should know A dojirepresents an equilibrium between supply and demand a tug of war that neither the bulls nor bears are winning.

Best candlestick banker s candlestick trading explained what is basic anese candlestick patterns forex candlestick definition profitf Forex Candlesticks A Plete For TradersForex Candlesticks A Plete For TradersMost Powerful Anese Candlestick Patterns In Forex TradingForex Candlesticks A Plete For TradersForex Candlestick Patterns And How To Use ThemHow To Read The Candlestick Chart In Forex. Each pattern has a specific meaning it shows the attitude of. In other words candlestick patterns help traders.

If you are a trader or a programmer who is inching to venture into algorithmic trading then we have the Executive Programme in Algorithmic Trading EPAT for you. The ability to read candlesticks allows the price action trader to become a meta-strategist taking into account the behaviors of other traders and large-scale market-movers. One short-bodied candle between a long red and a long green.

Candlesticks are useful when trading as they show four price points open close high and low. The Hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Dark cloud cover candlestick patterns indicate an incoming bearish reversal.

The candlestick patterns in this group indicate that the price may continue going up even though it appears to be taking a breather at the moment. After a downtrend the Hammer can signal to traders that the downtrend could be over and that short positions could potentially be covered. A two candle pattern the first candle is a long green bullish candle.

In the case of an uptrend the bulls have by definition won previous battles because prices have moved higher. Candlestick chart patterns are a way to read the price of a market instrument. In other words you see these patterns when the price is already trending up and they show that price is likely to go even higher.

Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. It is a three-stick pattern. A three-day bullish reversal pattern consisting of three candlesticks - a long-bodied black candle extending the current downtrend a short middle candle that gapped down on the open and a long-bodied white candle that gapped up on the open and closed above the midpoint of the body of the first day.

Now the outcome of the latest skirmish is in doubt. The morning star candlestick pattern is considered a sign of hope in a bleak market downtrend. This is on of the strong reversal candlestick patterns.

Bullish Continuation Candlestick Patterns. In this article you will learn everything you need to master candlesticks patterns like a true professional. Candlestick charts are a type of financial chart for tracking the movement of securities.

The Hammer helps traders visualize where support and demand are located. Patterns which helptraders make sense of market conditions and recognize advantageous times to enter trades. They have their origins in the centuries-old Japanese rice trade and have made their way into modern day.

A candlestick is a type of price chart used in technical analysis that displays the high low open and closing prices of a security for a specific period. Candlesticks are one type of chart that can be used in technical analysis to look for repeating patterns and in correlation with other technical indicators and signals. Since candles consist of 4 elements open high low and close they form into different shapes or Japanese candlestick patterns.

Candlestick charts have their origin in 17 th century Japan. Candlestick charts are used by traders to determine possible price movement based on past patterns. This makes them more useful than traditional open-high low-close bars or simple lines that.

Today candlestick charts are the preferred tool of analysis for traders and most investors since they provide all the required information at a glance. Here is a quick guide to different types of candlesticks and their meaning showing whether they are bullish bearish or neutral. They originated from Japan and are believed to have been invented by a rice trader called Munehisa Homma though it is highly likely that they developed a lot after their initial use.

It originated from Japanese rice.

02 Simple Candlestick Patterns Candlestick Chart Stock Chart Patterns Forex

02 Simple Candlestick Patterns Candlestick Chart Stock Chart Patterns Forex

Candlestick Patterns Pdf Free Guide Download Candlestick Chart Candlesticks Trading Charts

Candlestick Patterns Pdf Free Guide Download Candlestick Chart Candlesticks Trading Charts

10 Best Candlestick Pdf Guide 2020 Free Download Patterns Candlestick Chart Candlesticks Trading Charts

10 Best Candlestick Pdf Guide 2020 Free Download Patterns Candlestick Chart Candlesticks Trading Charts

Cryptocurrency Trading Candlesticks Chart Patterns For Beginners Album On Imgur Cryptocurrency Trading Trading Charts Candlestick Chart

Cryptocurrency Trading Candlesticks Chart Patterns For Beginners Album On Imgur Cryptocurrency Trading Trading Charts Candlestick Chart

How To Read Candlestick Charts Candlestick Chart Trading Charts Stock Trading Strategies

How To Read Candlestick Charts Candlestick Chart Trading Charts Stock Trading Strategies

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Charts Stock Chart Patterns Candlestick Chart

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Charts Stock Chart Patterns Candlestick Chart

How To Read Candlestick Charts For Stock Patterns Candlestick Chart Trading Charts Trading Quotes

How To Read Candlestick Charts For Stock Patterns Candlestick Chart Trading Charts Trading Quotes

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Profile Website

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Profile Website

Candlesticks Patterns Candlestick Chart Trading Charts Forex Trading Training

Candlesticks Patterns Candlestick Chart Trading Charts Forex Trading Training

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Candlestick Chart

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Candlestick Chart

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Charts Stock Chart Patterns Trading Quotes

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Charts Stock Chart Patterns Trading Quotes

Price Action How To Read Candles How To Analyse Candlestick Chart R Candlestick Chart Trading Charts Candlesticks

Price Action How To Read Candles How To Analyse Candlestick Chart R Candlestick Chart Trading Charts Candlesticks

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Stock Market

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Stock Market

Candlestick Patterns Anatomy And Their Significance Candlesticks Candlestick Chart Pattern

Candlestick Patterns Anatomy And Their Significance Candlesticks Candlestick Chart Pattern

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Candlestick Chart

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Candlestick Chart

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Trading Charts

Free Candlestick Stock Chart Patterns Meaning Thetradelocker Com Stock Chart Patterns Stock Charts Trading Charts

Candlestick Chart Pattern Forex Brokers Trading Charts Candlestick Chart

Candlestick Chart Pattern Forex Brokers Trading Charts Candlestick Chart

Candlestick Patterns Cheat Sheet Infographics Archive Candle Pattern Trading Charts Cheat Sheets

Candlestick Patterns Cheat Sheet Infographics Archive Candle Pattern Trading Charts Cheat Sheets

Price Action How To Predict Next Candlestick W Support And Resistanc Trading Charts Trend Trading Intraday Trading

Price Action How To Predict Next Candlestick W Support And Resistanc Trading Charts Trend Trading Intraday Trading

Thus this article Candlestick Chart Patterns Meaning

You are now reading the article Candlestick Chart Patterns Meaning with the link address https://candlestickstrading.blogspot.com/2021/02/candlestick-chart-patterns-meaning.html