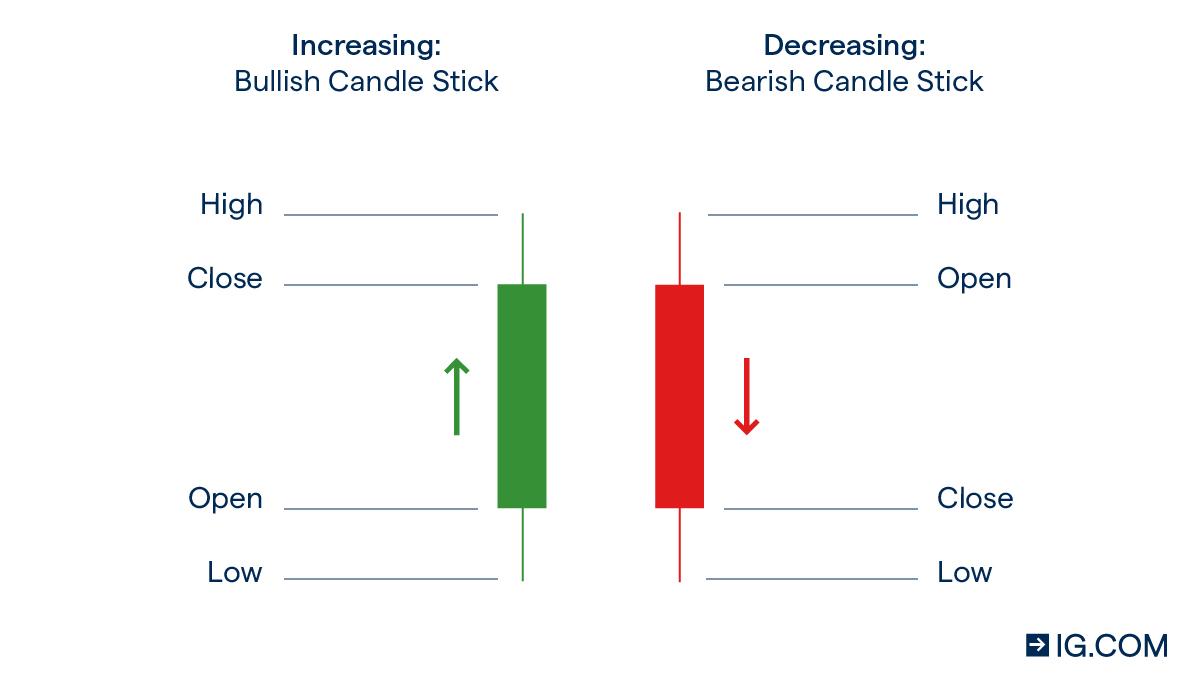

A candlestick depicts the battle between Bulls buyers and Bears sellers over a given period of time. A stock chart can display information ...

A candlestick is a type of price chart used in technical analysis that displays the high, low, open, and closing prices of a security for a specific period.