Title : Candlesticks Stock Patterns

Link : Candlesticks Stock Patterns

Candlesticks Stock Patterns

This is a bullish candlestick pattern that shows that buying pressure has quickly overcome a temporary. The shooting star is the same shape as the inverted hammer but is formed in an uptrend.

Fxwm Candle Stick Patterns Trading Charts Stock Market Stock Trading Strategies

Fxwm Candle Stick Patterns Trading Charts Stock Market Stock Trading Strategies

In this article we will cover 5 important bullish candlestick patterns.

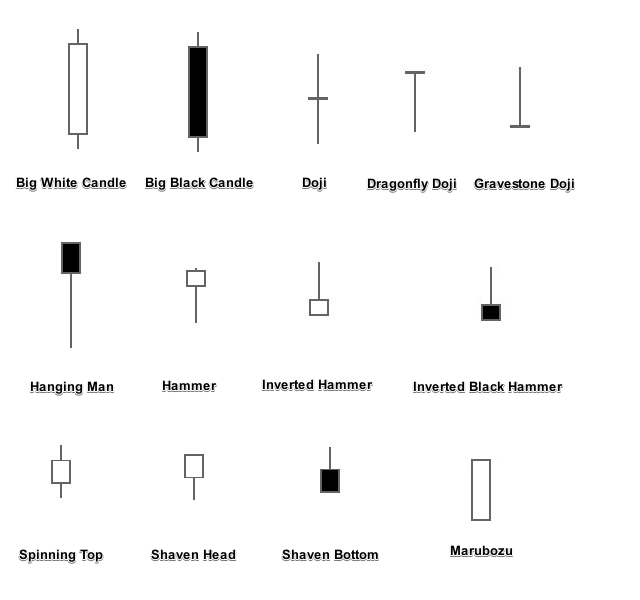

Candlesticks stock patterns. Candlesticks are useful when trading as they show four price points open close high and low. Patterns which helptraders make sense of market conditions and recognize advantageous times to enter trades. Over time groups of daily candlesticks fall into recognizable patterns with descriptive names like three white soldiers dark cloud cover hammer morning star and abandoned baby to name just a.

The patterns developed in the 1700s to track rice prices can be used on stocks commodities and foreign exchange. The candlestick pattern within the blue box in the middle of the chart is called a Bullish Engulfing. It happens when a candles body fully engulfs the body of the previous candle after a declining trend.

Candlestick patterns are formed by the combination of one or more candles. A bullish engulfing is a two-candle bullish reversal pattern. The first is.

It also contains three bodies a large body a small body and a red body candle. Quite simply it represents indecision and causes traders to question the current trend. Japanese Candlestick charts are designed to represent the supply and demand of any given market.

Candlestick charts are used by traders to determine possible price movement based on past patterns. In the case of an uptrend the bulls have by definition won previous battles because prices have moved higher. It has a small body with a long.

A two candle pattern the first candle is a long green bullish candle. In other words candlestick patterns help traders. The doji is probably the most popular candlestick pattern.

A three-day bullish reversal pattern consisting of three candlesticks - a long-bodied black candle extending the current downtrend a short middle candle that gapped down on the open and a long-bodied white candle that gapped up on the open and closed above the midpoint of the body of the first day. Their huge popularity has lowered. In fact most stock chart programs use candlesticks as the default mode.

It is referred to as a bullish engulfing. This can often trigger reversals in the opposite direction. The inverted hammer candle is basically an upside-down hammer candle.

Six bearish candlestick patterns Hanging man. The recognition of the pattern is subjective and programs that are used for charting have to rely on predefined rules to match the pattern. The stock opens up and goes nowhere throughout the day and closes right at or near the opening price.

There are mainly two types of candlestick patterns bullish candlestick pattern and bearish candlestick pattern. Generally the long shadow should be at least twice the length of the real body which can be either black or white. The hanging man is the bearish equivalent of a hammer.

It has a small. This is on of the strong reversal candlestick patterns. Dark cloud cover candlestick patterns indicate an incoming bearish reversal.

Now the outcome of the latest skirmish is in doubt. It is related to up trend and downtrend in the market trend. The opposite of a bullish engulfing candle a bearish engulfing candle pattern will move.

The ability to read candlesticks allows the price action trader to become a meta-strategist taking into account the behaviors of other traders and large-scale market-movers. In the following examples the hollow white candlestick denotes a closing print higher than the. The next candle opens higher but reverses and declines the candle then closes below the center of the first candle.

In financial technical analysis a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can predict a particular market movement. Not all candlestick patterns work equally well. There are over 120 different candlestick patterns to learn and recognize making the whole process of analysis very time-consuming.

It is a stock price candlestick patternit is used for technical analysis when the trend is going for a reversal pattern. It has the same shape but forms at the end of an. Candlestick Patterns Every trader should know A dojirepresents an equilibrium between supply and demand a tug of war that neither the bulls nor bears are winning.

It is used to detect future price lines. There are two pairs of single candlestick reversal patterns made up of a small real body one long shadow and one short or non-existent shadow. Bullish Candlestick Patterns The Hammer.

The 5 Most Powerful Candlestick Patterns Candlestick Pattern Reliability. The engulfing pattern suggests a potential trend reversal. 4 Best Candlestick Patterns for 2021 Bullish Engulfing Candlestick.

The first candlestick has a small body that is completely engulfed by the second candlestick. A bullish engulfing candle pattern is formed when the price of a stock moves beyond both.

نتیجه تصویری برای How To Trade With Candlestick Candlestick Chart Trading Charts Forex Trading Training

نتیجه تصویری برای How To Trade With Candlestick Candlestick Chart Trading Charts Forex Trading Training

5 Candle Stick Signals And Patterns Candlestick Chart Trading Charts Forex Trading Training

5 Candle Stick Signals And Patterns Candlestick Chart Trading Charts Forex Trading Training

Identifying Some Forex Candlestick Patterns 1st Forex Broker Forex Brokers Trading Charts Candlestick Chart

Identifying Some Forex Candlestick Patterns 1st Forex Broker Forex Brokers Trading Charts Candlestick Chart

Step By Step Strategies And Signals That Work Trading Walk Trading Charts Stock Trading Strategies Trading Strategies

Step By Step Strategies And Signals That Work Trading Walk Trading Charts Stock Trading Strategies Trading Strategies

Candlestick Reversal Patterns Trading Charts Stock Chart Patterns Forex Trading Training

Candlestick Reversal Patterns Trading Charts Stock Chart Patterns Forex Trading Training

Candlestick Patterns Reference Trading Charts Stock Chart Patterns Stock Trading Strategies

Candlestick Patterns Reference Trading Charts Stock Chart Patterns Stock Trading Strategies

Candlestick Patterns Cheat Sheet Infographics Archive Candle Pattern Trading Charts Cheat Sheets

Candlestick Patterns Cheat Sheet Infographics Archive Candle Pattern Trading Charts Cheat Sheets

Forex Candlestick Patterns Cheat Sheet Candlestick Chart Trading Charts Stock Charts

Forex Candlestick Patterns Cheat Sheet Candlestick Chart Trading Charts Stock Charts

Tweets With Replies By Beanfxtrader Beanfxtrader Twitter Stock Chart Patterns Trading Charts Forex Trading Quotes

Tweets With Replies By Beanfxtrader Beanfxtrader Twitter Stock Chart Patterns Trading Charts Forex Trading Quotes

Candlesticks Patterns Cheat Sheet Top Patterns Steemit Trading Charts Candlestick Chart Stock Chart Patterns

Candlesticks Patterns Cheat Sheet Top Patterns Steemit Trading Charts Candlestick Chart Stock Chart Patterns

Each And Every Candlestick Matters Just Like Each And Every Cell In The Body Matters Candlestickpatter Trading Charts Trading Quotes Forex Trading Training

Each And Every Candlestick Matters Just Like Each And Every Cell In The Body Matters Candlestickpatter Trading Charts Trading Quotes Forex Trading Training

02 Simple Candlestick Patterns Candlestick Chart Stock Chart Patterns Forex

02 Simple Candlestick Patterns Candlestick Chart Stock Chart Patterns Forex

Stock Market Basics Candlestick Patterns Toughnickel Money Stock Market Basics Stock Market Stock Market Chart

Stock Market Basics Candlestick Patterns Toughnickel Money Stock Market Basics Stock Market Stock Market Chart

Cryptocurrency Trading Candlesticks Chart Patterns For Beginners Imgur Cryptocurrency Trading Trading Charts Candlestick Chart

Cryptocurrency Trading Candlesticks Chart Patterns For Beginners Imgur Cryptocurrency Trading Trading Charts Candlestick Chart

10 Best Candlestick Pdf Guide 2020 Free Download Patterns Candlestick Chart Candlesticks Trading Charts

10 Best Candlestick Pdf Guide 2020 Free Download Patterns Candlestick Chart Candlesticks Trading Charts

Google Image Result For Https Www Forexelite Com Wp Content Uploads Forex Candlestick Patterns Cheat Sheet Png Trading Charts Candlesticks Forex

Google Image Result For Https Www Forexelite Com Wp Content Uploads Forex Candlestick Patterns Cheat Sheet Png Trading Charts Candlesticks Forex

Identifying Some Forex Candlestick Patterns 1st Forex Broker Trading Quotes Trading Charts Trading Strategies

Identifying Some Forex Candlestick Patterns 1st Forex Broker Trading Quotes Trading Charts Trading Strategies

Price Action How To Predict Running Candlesticks Predicting The Dire Trading Charts Forex Books Forex

Price Action How To Predict Running Candlesticks Predicting The Dire Trading Charts Forex Books Forex

03 Complex Candlestick Patterns Candlestick Chart Stock Chart Patterns Trading Charts

03 Complex Candlestick Patterns Candlestick Chart Stock Chart Patterns Trading Charts

Thus this article Candlesticks Stock Patterns

You are now reading the article Candlesticks Stock Patterns with the link address https://candlestickstrading.blogspot.com/2020/12/candlesticks-stock-patterns.html