Title : Candlestick Chart Patterns Explained

Link : Candlestick Chart Patterns Explained

Candlestick Chart Patterns Explained

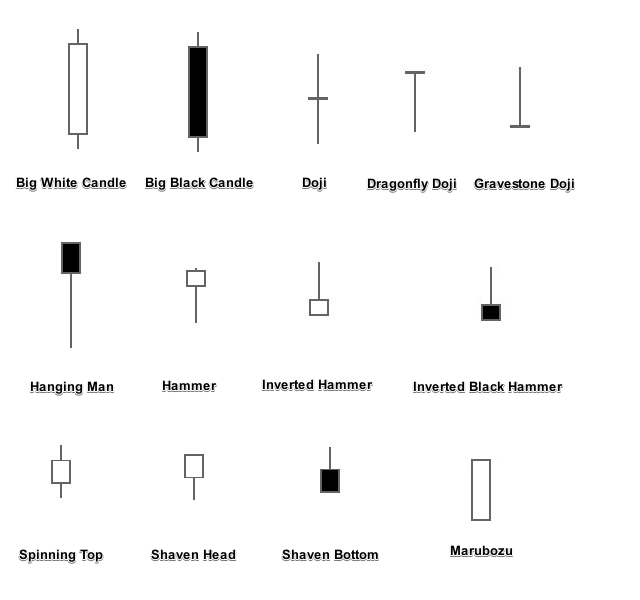

A hammer is a candlestick pattern that plots on the indicator chart when the security trades are low than openings. Candlesticks derive their name from the long lines wicks and rectangular shapes they employ to denote price action within a specified timeframe.

How To Read Candlestick Charts Candlestick Chart Trading Charts Stock Trading Strategies

How To Read Candlestick Charts Candlestick Chart Trading Charts Stock Trading Strategies

I cant stress this enough.

Candlestick chart patterns explained. The 5 Most Powerful Candlestick Patterns Candlestick Pattern Reliability. They are able to be used on every time frame and are utilized by long term investors swing traders and day traders. A candlestick chart represents the overall designed with whole candlesticks within a single time frame.

Too many traders get focused solely on the actual candlestick pattern that appears however the CONTEXT is equally as important if not more important. Doji This candle has zero or almost zero range between its open and close. Here we explain the candlestick and each element of the candle itself.

In the following examples the hollow white candlestick denotes a closing print higher than the. Then we explain common candlestick patterns like the doji hammer and gravestone. The chart below demonstrates some of the innumerable patterns formed by candlesticks in the context of a daily price action chart.

As an example a 15 minutes Candlestick chart represent the arrangement of multiple 15 minutes candle organized one by one in a manner. A candlestick price chart is made up of lots of individual candles that have different shapes which form different candlestick patterns. How to read the Candlestick Patterns Traders use candlestick charts to represent an assets price evolution.

And with its color coding and visible shapes and patterns you can easily see whats happening in the market at a glance. A key to ALL candlestick chart patterns is that they must always be interpreted in context with the current market structure not solely in isolation. A two candle pattern the first candle is a long green bullish candle.

Reading Stock Charts using Japanese Candlestick Pattern is Always a Matter of concern for Beginners in the Stock Market but Learning How to read stock Chart. It happens when a candles body fully engulfs the body of the previous candle after a declining trend. Candlestick Charts Explained Candlestick charts create formations and patterns such as those shown in chart patterns page that are a type of stock market technical analysis and are used in stock chart displays.

Candlestick charts are perhaps the most popular trading chart. A single candlestick patterns or candlestick charts formed by multiple candlesticks with a specific time frame. The candlestick chart provides a lot of useful information about what price has done within the specified timeframe.

These patterns will be discussed and elaborated upon in the remainder of this guide. Generally the long shadow should be at least twice the length of the real body which can be either black or white. The next candle opens higher but reverses and declines the candle then closes below the center of the first candle.

Bullish candlestick These are green candles and it shows that that the price has increased over the selected time period. The candlestick pattern within the blue box in the middle of the chart is called a Bullish Engulfing. So weve developed a guide to teach you about candlesticks and how to use them in your trading.

Candlestick charts are used by traders to determine possible price movement based on past patterns. Candlesticks are useful when trading as they show four price points open close high and low. Not all candlestick patterns work equally well.

Stock candle patterns explainedDoji is a set stock candle patterns explained of unique candlestick patterns that are standard formation in candlestick charts. Dear Reader We chose to show you this article as an introduction to our Trade and Invest category because we think you will find it extremely useful to improve your knowledge and to have an easy guide to read every time you need help with your trades and investments. This pattern draws hammer-shaped candlestick pattern in which shadows are at least twice the real size of the pattern body.

There are two pairs of single candlestick reversal patterns made up of a small real body one long shadow and one short or non-existent shadow. Their huge popularity has lowered. A bullish engulfing is a two-candle bullish reversal pattern.

Dark cloud cover candlestick patterns indicate an incoming bearish reversal. For this reason we added a PDF simplified version of Candlestick Patterns Explained that you can save and use. Candlestick patterns are a form of technical analysis and charting used in the stock market forex market and all other markets.

Hammer has a small body it occurs when the price is dead. This is on of the strong reversal candlestick patterns. With a wealth of data hidden within each candle the patterns form the basis for many a trade or trading strategy.

There are three types of candlestick candles.

10 Best Candlestick Pdf Guide 2020 Free Download Patterns Candlestick Chart Candlesticks Trading Charts

10 Best Candlestick Pdf Guide 2020 Free Download Patterns Candlestick Chart Candlesticks Trading Charts

How To Analyse Candlestick Chart 1 Minute Candlestick Live Trading 2017 Part 1 Youtube Candlestick Chart Trading Courses Forex Trading

How To Analyse Candlestick Chart 1 Minute Candlestick Live Trading 2017 Part 1 Youtube Candlestick Chart Trading Courses Forex Trading

Candlestick Patterns Cheat Sheet Trading Charts Stock Market Stock Trading Strategies

Candlestick Patterns Cheat Sheet Trading Charts Stock Market Stock Trading Strategies

Forex Candlestick Patterns Cheat Sheet Candlestick Chart Trading Charts Stock Charts

Forex Candlestick Patterns Cheat Sheet Candlestick Chart Trading Charts Stock Charts

How To Read Candlestick Charts For Stock Patterns Candlestick Chart Trading Charts Trading Quotes

How To Read Candlestick Charts For Stock Patterns Candlestick Chart Trading Charts Trading Quotes

Day Trading Technical Analysis Candlestick Chart Course Trading Quotes Trading Charts Candlestick Chart

Day Trading Technical Analysis Candlestick Chart Course Trading Quotes Trading Charts Candlestick Chart

Japanese Candlestick Patterns Candlestick Chart Trading Charts Candle Pattern

Japanese Candlestick Patterns Candlestick Chart Trading Charts Candle Pattern

Candlestick Chart Patterns Explained Belajar Pendidikan Investasi

Candlestick Chart Patterns Explained Belajar Pendidikan Investasi

5 Candle Stick Signals And Patterns Candlestick Chart Trading Charts Forex Trading Training

5 Candle Stick Signals And Patterns Candlestick Chart Trading Charts Forex Trading Training

Hammer Candlestick Chart Pattern Candlestick Chart Trading Quotes Forex Trading

Hammer Candlestick Chart Pattern Candlestick Chart Trading Quotes Forex Trading

03 Complex Candlestick Patterns Candlestick Chart Stock Chart Patterns Trading Charts

03 Complex Candlestick Patterns Candlestick Chart Stock Chart Patterns Trading Charts

Candlestick Patterns Cheat Sheet Infographics Archive Candle Pattern Trading Charts Cheat Sheets

Candlestick Patterns Cheat Sheet Infographics Archive Candle Pattern Trading Charts Cheat Sheets

02 Simple Candlestick Patterns Candlestick Chart Stock Chart Patterns Forex

02 Simple Candlestick Patterns Candlestick Chart Stock Chart Patterns Forex

Identifying Some Forex Candlestick Patterns 1st Forex Broker Trading Quotes Trading Charts Trading Strategies

Identifying Some Forex Candlestick Patterns 1st Forex Broker Trading Quotes Trading Charts Trading Strategies

Step By Step Strategies And Signals That Work Trading Walk Trading Charts Stock Trading Strategies Trading Strategies

Step By Step Strategies And Signals That Work Trading Walk Trading Charts Stock Trading Strategies Trading Strategies

Do You Trade These Candlesticks Comment Your Best Candlestick Chart Pattern Ours Is The Three Line Str Candlestick Chart Trading Charts Stock Chart Patterns

Do You Trade These Candlesticks Comment Your Best Candlestick Chart Pattern Ours Is The Three Line Str Candlestick Chart Trading Charts Stock Chart Patterns

Cryptocurrency Trading Candlesticks Chart Patterns For Beginners Imgur Cryptocurrency Trading Trading Charts Candlestick Chart

Cryptocurrency Trading Candlesticks Chart Patterns For Beginners Imgur Cryptocurrency Trading Trading Charts Candlestick Chart

Pure Power Picks On Instagram Here Are Some Basic Candlestick Patterns To Look For When Trading Often Trading Charts Stock Trading Strategies Trend Trading

Pure Power Picks On Instagram Here Are Some Basic Candlestick Patterns To Look For When Trading Often Trading Charts Stock Trading Strategies Trend Trading

Candlestick Cheat Sheet Belajar Investasi Pendidikan

Candlestick Cheat Sheet Belajar Investasi Pendidikan

Thus this article Candlestick Chart Patterns Explained

You are now reading the article Candlestick Chart Patterns Explained with the link address https://candlestickstrading.blogspot.com/2021/06/candlestick-chart-patterns-explained.html